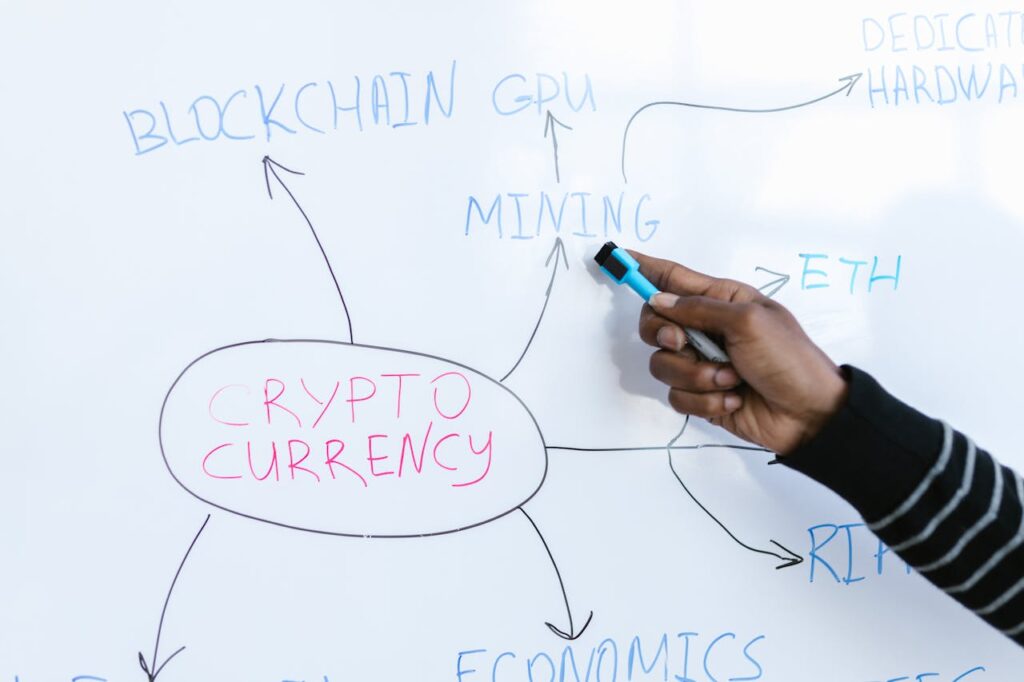

Cryptocurrency represents a new wave of digital or online currency. It has become recently a mode of currency and is widely acknowledged and used all over the world. This is not in the same light as dollar or euro-type currencies, which are centralized because it is not operated by a central authority like a government or financial institution. However, it runs through a network of computers in a peer-to-peer fashion via cryptographic methods to secure a particular transaction as well as the creation of new units of currency.

This is the combination of all those qualities that has made cryptocurrency an interesting topic sometimes controversial and highly hot in the financial world. In the following guide, we are going to analyze what cryptocurrency is and how it works for you as a beginner to get started with.

Table of Contents

Understanding Cryptocurrency

It’s useful first to dissect cryptocurrency’s essential elements: digital, decentralized, and cryptography.

- Digital: There is no physical version of coins and banknotes for cryptocurrencies. Records of all the transactions and ownership are kept as electronic records. Since it’s in a digital form, access and transfer it easily via a computer, a cell phone, and any device.

- Decentralized: The decentralized currencies of the new ones are where traditional currencies are issued and controlled by central banks. This implies that neither the government nor any financial institution has the authority over it.

- Information security is achieved by employing mathematical techniques which is termed cryptography. Cryptocurrency uses the service of cryptography, which allows cryptocurrency to monitor coin creation and, therefore, allow transactions with secrecy, privacy in transactions, or verification of any asset transfers safely.

Blockchain Technology: The Backbone of Cryptocurrencies

The core technology that powers cryptocurrencies is blockchain. One type of distributed ledger, recording transactions via a network of computers, is a blockchain. Data blocks, where each contains a list of transactions, form a blockchain. This is because these blocks are connected in the historical order that creates a “chain” of data, which is why it is called “blockchain.” Given blockchain’s decentralized structure, no central entity can ever modify or even tamper with the transaction ledger. Since changing a block is virtually impossible post its inclusion into the chain, blockchain technology indeed provides an overwhelmingly secure and transparent method of maintaining transaction records and this immutability is partly why cryptocurrencies have been regarded as safe and reliable.

How Cryptocurrency Works

Peer-to-peer, or P2P, networking is the basis of cryptocurrency transactions. The transaction is broadcast to the network, where users known as “miners” validate it. The miners make verification and append the transaction to the blockchain by using very powerful computers that solve complex mathematical challenges. After that verification, the transaction is put into a new block. Then, this block is appended to the current blockchain. Computing power is used in the mining process to perform these verifications and solve mathematical problems. Miners are paid for their efforts in terms of transaction fees by consumers or newly minted cryptocurrency currencies such as Bitcoin.

Popular Cryptocurrencies

The first-ever cryptocurrency was Bitcoin. To date, it remains the most widely used and popular digital asset. The origins are shrouded in mystery because its inception is accredited to a person or a group known as Satoshi Nakamoto back in 2009. It was with this intention of designing an alternative system, away from the traditional currency systems, and without having to pass through the central authority that one would go through in terms of banks or government. Since the introduction of Bitcoin, numerous other cryptocurrencies have been developed, each possessing distinct features and specific applications. The following are the most popular options:

- Ethereum: Ethereum enables developers to create and execute smart contracts-self-executing agreements with terms directly encoded-on its decentralized platform. The proprietary coin used to fuel network transactions and computational services is called Ether or ETH.

- Litecoin: This is sometimes known as “silver to bitcoin’s gold.” It is a peer-to-peer cryptocurrency. It is very cheap, and transactions are quicker as compared to more popular Bitcoin. Charlie Lee marketed Litecoin in the year 2011. Its concept is it can execute speedier and successful transactions compared with Bitcoin.

- Ripple: This is a coin as well as a protocol for digital payments. The Ripple protocol mainly aims at making the transfer of international money fast and inexpensive. In the Ripple network, the transactions are enabled by the cryptocurrency used for the Ripple protocol known as XRP.

- Cardano: The blockchain technology here provides a very developer-friendly version of smart contracts and dApps on a more scalable and safer base. There is a lot, but this, for example, is much energy-friendlier than Bitcoins function, which relies on a consensus mechanism of proof-of-stake.

There are many more; however, these are just examples. Each currency has its use, user base, and even developer community.

Guidelines for Purchasing and Safeguarding Cryptocurrency

Acquiring cryptocurrency is the initial step towards engaging with its use. You will likely find various methods to acquire Bitcoin; however, it has become evident that using an exchange is currently one of the most effective options available. In general, the cryptocurrency exchange simply is an online market where one can trade and sell or even buy cryptocurrencies; the most commonly used ones of this kind of service are Binance, Gemini, Kraken, and Coinbase. After buying the cryptocurrency, one should take some care in storing it. You can hold the cryptocurrency on the exchange, but it’s generally safer to move it into an individual wallet. Wallets are of two types.

- Hot Wallets- These are wallets that exist through software, making them accessible on the internet for use. A hot wallet might not be as safe as a cold wallet but for those who prefer to make over one transaction over a short duration, they make great options.

- Cold Wallets- Cold wallets are referred to as hardware devices or offline storage media that do not use the internet. It’s ideal for storing cryptocurrencies in the long term. It adds more security to it.

Risks and Considerations

While cryptocurrency offers many advantages, it is not without its risks. Some of the key risks to consider include:

- Volatility: It is possible to have a huge price volatility when dealing with cryptocurrencies, thereby making them perilous bets for the investor. Some cryptocurrency traders have received colossal returns, but others have lost a lot of money due to price crashes.

- Regulatory Uncertainty: Regulating cryptocurrencies remains a work in progress for the governments of most countries in the world. Some nations completely ban cryptocurrencies, while others do it strictly; this creates an uneasy feeling in the minds of users and investors.

- Security: Even though blockchain technology is secure, bitcoins may get hacked or stolen from the wallets and the actual exchange. Ensure you are safe by creating good passwords, having activated two-factor authentication, and keeping your money in a safe wallet.

Conclusion

The field of cryptocurrency is very intricate and developing quickly, and it can transform the financial sector completely. Cryptocurrencies offer something that no form of traditional money can – decentralized digital assets with protection via cryptography. The underlying technology, blockchain, is the most exciting of all of its applications; yet, dangers also need to be known. It is quite important that newcomers learn and update themselves with new market changes, and ensure to take proper precautionary measures before securing their money. Cryptocurrencies present a very interesting new frontier in the digital economy-be it for investments, use for commerce or just to find out more about the underlying technology.