The finance world is witnessing a major transformation, mainly connected to technology and the hunt for the most relevant, open, and secure financial systems. Probably the most awesome development in the contemporary world is the decentralization of Financial operations, simply known as Defi. This novel concept is changing the way we think about capital, the existing systems of capital gain, and the banking structure is further extended. Hence, the next question is, what does DeFi mean and why is it the future of banking? So, let’s catch up with it.

Table of Contents

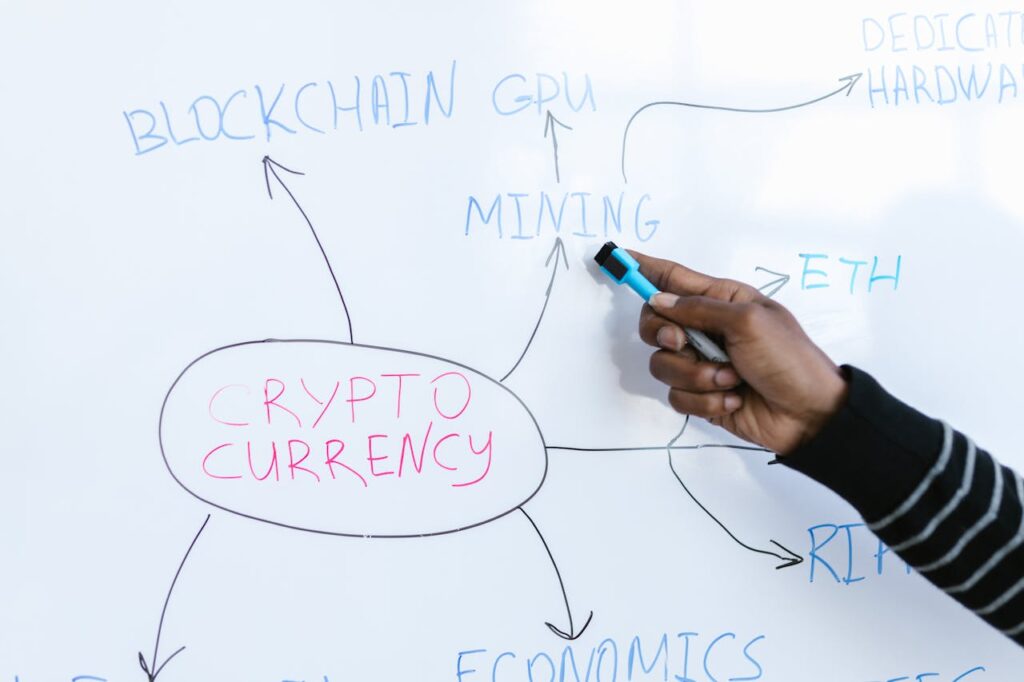

What is DeFi?

The notion of Decentralized Finance refers to a financial service sector with blockchain as its basis. It consists of all those social and technical infrastructure that’s enabled via public blockchain technology and can provide permissionless, free, and decentralized finance; moreover, it’s an open financial system that can be used by any person with an internet connection who wants to lend, borrow, trade, and earn interest. For DeFi, Ethereum has remained the leader, but Binance Smart Chain, Solana, and Avalanche are three other platforms that people are increasingly attracting in this sphere.

Key Components of DeFi

- Smart Contracts: DeFi is a concept dependent primarily on smart contracts. Smart contracts are auto-executive when certain conditions are met while the middle-man is being made unnecessary through the actions themselves. These smart contracts are agreed upon by both parties and self-executed. They are automatically executed when the conditions in the code are met. Thus, the middleman is removed.

- Decentralized Applications (dApps): dApps are blockchain applications designed to offer various financial services. Some of the examples of these are Uniswap, which is for decentralized trading, and Aave, which is for lending and borrowing.

- Stablecoins: In essence, these are digital currencies that are pegged to the U.S. dollar, ensuring the stability of the coin and thus its price. In the decentralized finance sector, quite popular stablecoins are USDC, DAI, and Tether.

- Decentralized Exchanges (DEXs): DEXs stand apart from the classic exchanges in that they allow the participants to trade among themselves directly with no intermediary. As an example, SushiSwap is fully decentralized and operates without human intervention by leveraging the smart contracts technology.

- Liquidity Pools: Users can offer their crypto assets to trading sets that, in turn, theoretically operate as standalone entities on DEXs.

How Does DeFi Work?

The basis of DeFi is smart contracts, which are embedded in blockchain networks. For understanding, I’ll provide you with a very basic example to put you in the light on how DeFi works:

- Lending and Borrowing: Let’s say you have some Ethereum you want to make money from. You can put your Ethereum onto DeFi lending platforms like Aave or Compound. You may provide liquidity in this way which in turn means that you will get interest on your deposit.

At this point, someone who needs a loan can withdraw from this liquidity pool. The borrower has to give his property (often more than the loan amount to mitigate the risk) and also pay interest. The program places the request and provides all the necessary steps automatically, so no human interference is involved guaranteeing transparency and security.

Benefits of DeFi

- Accessibility: DeFi is a market that is open to any person with an Internet connection. You don’t have to go through the hassle of credit checks, and paperwork or also have given geographic limitations.

- Transparency: Besides, transactions are visible because they are all saved on a public blockchain ledger which can be accessed by anyone. The kind of clarity that is prevalent in the traditional finance sector is unknown.

- Control: Customers decide whatever they want to do with their digital assets. There’s no need to give a bank or financial institution all your cash.

- Innovation: The rising popularity of DeFi has brought about the establishment of partnerships and a great amount of innovation when it comes to the type of financial products and tools that were never in existence before, such as flash loans and yield farming.

- Cost Efficiency: DeFi lowers operating costs and speeds up business by cutting out the middlemen.

Risks and Challenges

Even though DeFi comes with several benefits, it also involves some risks:

- Smart Contract Vulnerabilities: Smart contract code often consists of bugs or other security flaws, which are easily exploited by cybercriminals. Therefore, resources and data can be lost.

- Regulatory Uncertainty: The decentralized finance utility is an irregular industry and its restrictions for regulations are not fixed yet. Authorities in various countries may decide to impose rules, which may potentially threaten the development and smooth running of DeFi service providers.

- Market Volatility: DeFi projects are greatly impacted by this phenomenon, and even though stablecoins help mitigate these issues, the lack of consistency in the crypto market does not help in DeFi investment discussions.

- Lack of Consumer Protection: Unlike in traditional finance, where regulatory bodies ensure certain levels of customer protection, the DeFi sector is regarded as a user-centered environment. It is the well-aware clients who only can decide the level of security they want.

- Complexity: The intricate nature of DeFi platforms is what might intimidate new students and that in turn increases the possibility of them making mistakes.

Popular DeFi Applications

- Uniswap: A first-class catering DEX that is the best decentralized exchange in DeFi enabling all wallet operations such as exchanging of ERC-20 tokens, drawing directly via the wallet, and others.

- Aave: It is a DeFi protocol that allows the making of various loans with the feature of flash loans and setting them variable or fixed interest rates.

- Compound: Users are offered the option to earn deposit interest or take out loans with their own money.

- MakerDAO: A company that is crowdsourced through decentralized voting and makes sure the DAI stablecoin is locked in suitable collateral and only the right amount is created.

- Yearn. finance: It is a platform of yield that by moving the user crypto into lending protocols enhances the investment to the maximum with automation.

The Future of Banking: Is DeFi the Answer?

Banks want their clients to continue to engage with them and that’s why they make good efforts to deliver new services, but the question is whether DeFi will stand in their way. Here are some key considerations:

- Complementary Rather Than Replacement: DeFi is a form of traditional finance because of its similar structure and status as a service provider. The difference is that the inclusion of DeFi balances special offers that regular banks do not make.

- Financial Inclusion: DeFi is a new development that is a good opportunity to provide banking services to different people, especially in underdeveloped countries where old banking practices do not work anymore.

- Institutional Adoption: Institutions are increasingly warming up to the idea of DeFi but using the traditional way. Meanwhile, some are changing things up by including DeFi technology in their services.

- Development of legal basis: As DeFi growth becomes a reality, the existing legal regulatory framework will likely get replaced with new ones that include the decentralized systems that also protect the consumer.

How to Get Started with DeFi

- Educate Yourself: Learn about the foundations of blockchain, cryptocurrencies, and DeFi platforms.

- Choose a Wallet: Make sure you get a non-custodial wallet such as MetaMask for DeFi computing.

- Fund Your Wallet: Acquire cryptos like Ethereum through a platform like Binance and deposit them in your DeFi wallet.

- Explore dApps: Begin with well-known DeFi services – Uniswap, Aave, or Compound.

- Practice Caution: Risk no more than a small amount, recheck every transaction, and make sure you are investing only spare assets.

Final Thoughts

Decentralized finance (DeFi) marks a shift away from traditional financial activities toward a digital money ecosystem. A technology that promises to bring about transparency, accessibility, and efficiency is DeFi, which is a more attractive option than traditional banking systems. This new and innovative technology, however, requires careful negotiation of both risks and challenges. The DeFi is an ecosystem that can potentially revolutionize and reconfigure our concept of money and financial services as it grows. Whether you are a curious starter or a knowledgeable investor, monitoring DeFi is pivotal in a globe where the financial industry is changing rapidly.