Table of Contents

- 1 Introduction: The Dawn of Digital Central Banking

- 2 The Rapid Evolution of Digital Finance

- 3 What Are CBDCs?

- 4 Bridging Traditional Finance and Blockchain

- 5 Quant’s Role in CBDC Implementation

- 6 Understanding Quant’s Interoperability Solution: Overledger

- 7 Solving the “Internet of Blockchains” Challenge

- 8 The Architecture of Interoperability

- 9 The Significance of Interoperability for CBDCs

- 10 Quant’s Active Role in CBDC Development

- 11 Project Rosalind and Beyond: Quant’s Contributions to CBDC Innovation

- 12 Technical Contributions to CBDC Infrastructure

- 13 Case Studies: The Digital Pound and Others

- 14 The QNT Token: Fueling the Interoperable CBDC Future

- 15 Economic Impact and Market Analysis

- 16 Navigating the Challenges of CBDC Implementation

- 17 Regulatory Hurdles: Compliance and Security

- 18 Technical Challenges and Solutions: Scalability, Security, and Interoperability

- 19 The Future of CBDCs and Quant’s Strategic Positioning

- 20 Emerging Trends and Technologies: Privacy and Smart Contracts

- 21 Global Adoption Scenarios: Quant’s Strategic Role

- 22 Expert Opinions and Predictions

- 23 Bridging the Gap to a Digital Financial Future

- 24 Recap of Quant’s Contributions

- 25 The Transformative Potential of CBDCs

Introduction: The Dawn of Digital Central Banking

The Rapid Evolution of Digital Finance

The world of finance is experiencing a significant transformation. According to an estimate of 2023 created by BIS The Bank for International Settlements (BIS), over thirty international locations have begun to research or expand Central Bank Digital Currencies (CBDCs). It is a staggering ninety percent of the world’s GDP. The rise of CBDCs represents an important moment in the growth of money. crucial banks across the globe are trying to upgrade their economic systems and enhance the performance of their charge, and safeguard economic sovereignty within a digitally advancing global.

What Are CBDCs?

Central Bank Digital Currencies (CBDCs) are the digital versions of a country’s fiat currency that are issued and administered by the central bank. In contrast to cryptocurrency, which includes Bitcoin as well as Ethereum as well as run on decentralized platforms CBDCs are centralized and fully backed by the governing body that issues them. They seek to combine the benefits of digital currencies – which are faster transactions, lower costs, and faster economic integration–with the stability and faith associated with traditional fiat currency.

CBDCs can address a variety of issues within the financial system of today. They are able to reduce the dependence on cash that costs a lot to produce and disperse. They also provide a remedy to address the issues with payment across borders, which is typically slow, expensive as well as opaque. Additionally, CBDCs could enhance the financial inclusion of people by providing accessibility to payment methods that are digital for those who are not banked or underbanked population.

Bridging Traditional Finance and Blockchain

As central banks explore the potential of CBDCs, one of the key demanding situations they face is interoperability–the potential of different blockchain networks and legacy financial systems to speak and transact seamlessly. This is the point where the Quant Network plays a role.

In 2015, Quant Network was founded with the help of Gilbert Verdian, a seasoned cybersecurity expert, Quant Network has emerged as a major player in the world of blockchain. Quant Network’s mission is to address this “net of blockchains” task by allowing interoperability between various blockchain networks and older platforms. The core of Quant’s approach lies in Overledger the revolutionary technology that functions as an omnipresent gateway to blockchain connectivity.

Quant’s Role in CBDC Implementation

The blog suggests that Quant’s Overledger period is the only one to play a significant contribution to the successful introduction of CBDCs. With its seamless integration among exclusive blockchain networks as well as established financial infrastructures, Quant is helping to close the gap between traditional financial services and the digital future. As central banks all over the world are getting closer to launching personal CBDCs of their own Quant’s unique technology is set to be integral to the financial world.

Understanding Quant’s Interoperability Solution: Overledger

Solving the “Internet of Blockchains” Challenge

Quant Network was based on the idea of making a place where various blockchain networks are able to communicate and collaborate, in addition to traditional financial systems. It was conceived with imagination and a sense of prescience. because blockchain technology became increasingly dispersed, having a myriad of remote networks operating within isolated networks. The fragmentation created a significant obstacle to the widespread use of blockchain technology especially in the financial industry.

To fulfill this goal, Quant evolved Overledger, an application designed to allow the interoperability of unique blockchains as well as traditional platforms. Overledger functions as an API gateway, which allows builders to create applications that can be used across multiple blockchains and not be bound to one platform.

The Architecture of Interoperability

Overledger’s architecture is ingenuous and easy to understand. Its core is that Overledger serves as a layer over existing blockchain networks and provides a unified interface to gain access to and work with multiple blockchains. It does this by using an amalgamation of APIs (Application Programming Interfaces) and SDKs (Software Development Kits) which allow developers to connect their software to Overledger, and by extension, any community of blockchains that has been approved by the Overledger.

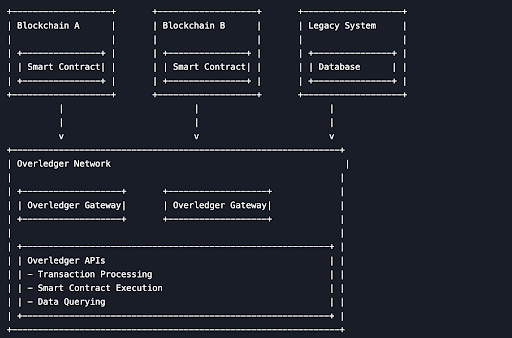

The main components of the structure of Overledger’s are:

- Overledger Network: The core of the network, enables the interconnection of different blockchains as well as older platforms.

- Overledger Gateway An essential component that functions as a bridge to the Overledger Network and person blockchain networks, which ensures that there is a seamless flow of information and communication.

- Overledger APIs APIs provide developers with the necessary tools to develop packages that work with multiple blockchains. They facilitate a broad variety of capabilities including the process of transactions, intelligent contract execution, and queries.

To show how Overledger operates take a look at the following illustration:

In this illustration, Overledger acts as a central hub connecting Blockchain A, Blockchain B as well as the Legacy System. Developers have the option of using Overledger APIs to create applications that communicate with the three networks, without the need to comprehend the basic complexity of each network.

The Significance of Interoperability for CBDCs

Interoperability is a crucial aspect of CBDCs’ success. For CBDCs to reach their full potential to be successful, they have to be able to communicate seamlessly with digital currencies of other types along with the existing financial infrastructure. This is especially important when it comes to move-border bills. it is necessary to be able to change costs between CBDCs that are unique as well as traditional currencies is crucial.

Quant’s Overledger technology meets the need for an open platform for interoperability in blockchain. By enabling a seamless exchange of information across different blockchain networks and older platforms, Overledger ensures that CBDCs are able to be integrated into the global financial system without impacting the existing infrastructure.

Quant’s Active Role in CBDC Development

Project Rosalind and Beyond: Quant’s Contributions to CBDC Innovation

Quant is making a significant contribution to several prominent central bank Digital Currency initiatives. These include Project Rosalind, a collaborative initiative supported by the Bank of England and the Bank for International Settlements. Project Rosalind explores CBDCs’ potential for consumer payments, focusing on increasing consumer satisfaction and that they are compatible with existing price methods.

Quant’s participation with Project Rosalind has been instrumental in showcasing the practical applications of the Overledger technology. Through the provision of an uninterrupted interface connecting various blockchain networks as well as legacy technology, Quant has enabled the goal of identifying new CBDC applications, comprised of smart, programmable money and contracts.

In addition to Project Rosalind, Quant has worked with a variety of major financial institutions and banks on CBDC assignments. Particularly, the firm collaborated with an institution called the European Central Bank (ECB) on the improvement of a digital currency and has partnered in conjunction with the Monetary Authority of Singapore (MAS) on Project Ubin, a multi-segment project that explores the potential of blockchain technology for clearing and settlement of securities and bills.

Technical Contributions to CBDC Infrastructure

Quant’s new generation tackles a myriad of issues in the development of CBDCs. They comprise security, scalability, and cross-border transactions.

- Security: CBDCs should be secure against cyber attacks as well as fraud. Quant’s Overledger Era incorporates the latest security options, including encryption as well as multi-signature authentication to ensure transaction integrity and privacy.

- The ability to scale: Since CBDCs are expected to manage massive volumes of transactions scalability is a major factor to take into account. Overledger’s architecture is built to support high-throughput services, making certain that CBDCs can grow as their adoption grows.

- Trans-Border Payments: One of the biggest use cases of CBDCs is cross-border payment. Overledger facilitates greater interoperability between CBDCs as well as conventional currencies. It allows speedier, cost-effective, and well as transparent transactions across the globe.

Case Studies: The Digital Pound and Others

The most popular CBDC project involving Quant can be The Digital Pound, a proposed digital currency using the help of the Bank of England. Quant played a significant part in the creation of the Digital Pound, presenting the technological infrastructure required to guarantee compatibility with the existing structures of monetary.

The Digital Pound project has made considerable progress with many trial programs already in progress. These trials have proven the CBDC’s potential for improving the efficiency of payment as well as reducing transaction fees and increasing the accessibility of monetary transactions. Quant’s contribution to this endeavor are widely recognized and many experts have praised Quant’s ingenuous approach to Blockchain interoperability.

As well as The Digital Pound, Quant has been concerned about a variety of different CBDC projects in the industry. As an example, Quant has collaborated with the Reserve Bank of Australia (RBA) on Project Atom which is which is a research project that studies CBDCs’ potential use for wholesale payment. This venture has shown positive results as Quant’s invention has allowed seamless integration between various blockchain platforms and legacy systems.

The QNT Token: Fueling the Interoperable CBDC Future

Utility and Value Proposition of the QNT Token

The QNT token is the primary currency of the Quant Network environment. It acts as the gasoline that powers the Overledger platform and allows users to join and use its various capabilities and products. The QNT token comes with a variety of essential functions in the marketplace:

- Access to Overledger Companies and developers have to keep QNT tokens to gain access to the Overledger platform, and also build applications using its interoperability capabilities.

- Transaction Fees: Quant Tokens are utilized to pay transactions on the Overledger network. This ensures that the platform remains safe and effective.

- Governance: The holders of Quant tokens have the opportunity to be part of the administration of the Quant Network, voting on important decisions and suggestions that determine the direction of the network.

The use of QNT tokens QNT tokens is firmly connected to the need to integrate into the CBDC sector. With more banks and financial institutions beginning to use CBDCs, the requirement to have seamless interoperability among unique blockchain networks as well as legacy systems is likely to grow. That, in turn, is likely to increase demand for the Quant token as it is essential to unlock the full power of the interoperability solutions offered by Overledger.

Economic Impact and Market Analysis

It is believed that the QNT token has demonstrated an excellent overall market performance over the past few years, driven due to the increasing demand for CBDCs as well as blockchain interoperability. By 2023, the QNT token will be part of an estimated market value of $1 billion. This makes it among the top 100 cryptocurrency by market capitalization.

The cost over the long term of QNT’s token is tightly linked to the use of CBDCs. With more central banks across the world launching their unique digital currency, the demand for interoperable services such as Overledger is expected to grow. The outcome will increase QNT’s value token, which will become an integral part of the worldwide CBDC community.

Regulatory Hurdles: Compliance and Security

One of the most challenging issues facing the introduction of CBDCs is their complicated regulatory environment. Central banks must deal with a multitude of rules and compliance standards, which range from anti-cash laundering (AML) and know-your-customer (KYC) guidelines to data privacy regulations and cybersecurity guidelines. For more information about AML and KYC rules, consult resources provided by organizations such as the Financial Action Task Force (FATF).

Quant is well-placed to handle these regulatory-related challenges. Quant is a company with a keen awareness of security and compliance and has a group of experts who specialize in cybersecurity and regulatory matters. Quant’s Overledger technology comes with high-end security options that include encryption and multi-signature authentication. This ensures that CBDCs are protected from security threats from cybercriminals and fraudulent activities.

Technical Challenges and Solutions: Scalability, Security, and Interoperability

Beyond any regulatory hurdles, Central Bank Digital Currencies (CBDCs) are facing some major technical issues as well as scalability security, as well as interoperability. To deal with the complexities, it is crucial to ensure CBDCs can manage the high volume of transactions associated with the virtual currency, with integrity and security.

Quant’s Overledger generation offers solid solutions to these issues:

- Scalability: Overledger’s structure was designed to support high throughput applications, allowing CBDCs to grow appropriately as the number of CBDCs they use increases.

- Security: This platform comes with advanced security features, that include multi-signature encryption as well as encryption to ensure integrity and privacy.

- Interoperability Overledger allows seamless exchange of information between particular blockchain networks as well as existing structures, allowing CBDCs to integrate into the financial system of the world without affecting existing infrastructures.

Through addressing these critical technological difficult situations Overledger assures CBDCs to be able to function correctly, safely, and efficiently within the constantly evolving economic virtual system.

The Future of CBDCs and Quant’s Strategic Positioning

Emerging Trends and Technologies: Privacy and Smart Contracts

The future of CBDC technology could develop through many innovations, and also advancements in privacy as well as smart contracts. Privacy is an important issue for CBDCs as the principal banks need to strike a balance between the requirement for transparency and the desire to ensure users’ privacy. Smart contracts, again offer the possibility to simplify complex economic transactions and allow new uses for CBDCs.

Quant’s technology is in line with these new features. Overledger’s structure is designed to support privateness-preserving technology, together with zero-understanding proofs, which permit transactions to be validated without revealing touchy information. Overledger can also assist smart contracts by allowing developers to create programs that simplify monetary transactions.

Global Adoption Scenarios: Quant’s Strategic Role

Since CBDCs can benefit from more widespread acceptance, a variety of possibilities of global adoption could be possible. A possible scenario would be the development of a multi-CBDC system that is, where exceptional primary banks struggle with their digital currencies, which could work with other CBDCs. A different scenario is the development of a global CBDC which is a product from a network of essential banks and utilized for cross-border payment.

In both cases, Quant’s generation has the potential to play a role in strategic planning. The interoperability features of Overledger allow an unimpeded exchange of information between CBDCs as well as traditional currencies, and make it a crucial component of any multi-CBDC program. Overledger provides the technology infrastructure necessary to facilitate the world’s CBDC which allows bills for move-border transactions to be processed faster more cost-effectively, as well as more easily.

Expert Opinions and Predictions

A lot of experts believe CBDCs could be a crucial element shortly of financial services. According to research conducted by the World Economic Forum (WEF), CBDCs can revolutionize the financial world and help to pay for faster, more affordable bill-paying, and more comprehensive costs. It also emphasizes the significance of interoperability stating that CBDCs ought to be capable of interacting seamlessly with all other digital currencies as well as the current economic infrastructure.

Quant’s technology aligns well with these forecasts. The interoperability capabilities of Overledger allow CBDCs to participate in the world’s financial environment which ensures that they can gain their full potential. When more banks in the world adopt CBDCs, Quant’s tech is likely to be a key component of the world’s financial system.

Bridging the Gap to a Digital Financial Future

Recap of Quant’s Contributions

Quant has been a major contributor to the creation of CBDCs. It has provided the infrastructure required to ensure interoperability among different blockchain networks as well as traditional structures. By using Quant’s Overledger tech, Quant has enabled relevant banks to identify the most advanced use scenarios for CBDCs. These comprise programmable cash as well as smart contracts.

The Transformative Potential of CBDCs

CBDCs are transforming the world’s economy, providing faster more affordable, less expensive, and higher comprehensive bills. But, for CBDCs to reach their maximum potential they must be capable of interfacing seamlessly with other currencies that are virtual and existing financial infrastructures. Quant’s Overledger technology provides the interoperability tools needed to connect conventional financial institutions and the digital future.

In the process of moving towards the use of CBDCs Individuals and companies must be aware of the latest trends and developments that are emerging in the field. Our readers should be inspired to learn about Quant’s generation in the same way and engage on the subject using sharing their ideas and thoughts. Together, we will help in shaping financial futures, and create an inclusive and effective worldwide monetary device.