Digital payments have sped up exponentially within the last ten years thanks to cryptocurrencies and blockchain technology. While the world becomes increasingly digitized, the next two giants of digital currencies—Stablecoins and Central Bank Digital Currencies, or CBDCs-are projected to be hailed as the revolutionizing transaction interface. Despite when comparing Stablecoins vs CBDCs, they could not be more different from one another in terms of structure, use, and governance. It is imperative to understand these differences as one decides which will dominate the future of digital payments.

Table of Contents

Understanding Stablecoins: The Promise of Stability

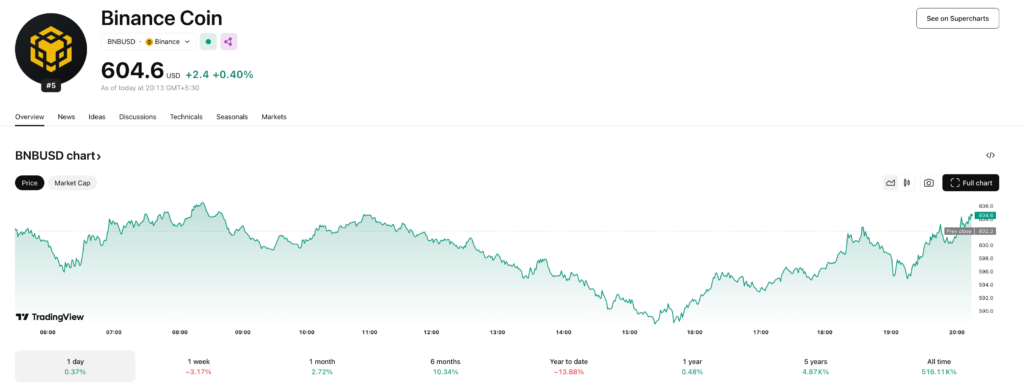

Stablecoins would stabilize the volatility of these other traditional coins, such as Bitcoin or Ethereum, stabilizing prices that are usually pegged concerning reserve assets, but fiat currency normally for example USD. The most evident advantage of stablecoins is to provide all of the benefits that digital assets deliver, cheaper cross-border payments with fiat currency stability. Stablecoins are a variety of stablecoins that have different mechanisms to maintain their value. Stable coins that are collateralized by fiat include Tether and USD Coin. They are backed by a specific reserve of fiat currency kept in the respective bank account. On the other hand, algorithmic stablecoins like TerraUSD adjust their supply through algorithms to keep pegs without having any physical reserves. Stablecoins have developed into an integral part of the ecosystem; on one side, there’s volatility associated with cryptocurrencies, and on the other side, the stables of traditional finance. They also produce liquidity on DeFi platforms; they go into trades, and more frequently now, it serves as an intermediate means of exchange for real-world usage. The decentralized nature, not dependent on any central authority, and transparency via blockchain technology have brought them into the limelight among both the individual user and the institutional investor.

CBDCs: Government-Backed Digital Currencies

CBDCs, on the other hand, are the electronic version of the fiat money issued by a country’s central banks. Unlike cryptocurrencies, they utilize decentralized networks and thus remain under the control of the central banks of various countries. The idea is to recreate the traditional fiat currency system in a digital mode and to give governments a way to modernize their financial infrastructure, enhance monetary policy, and combat the rise of private cryptocurrencies and stablecoins. CBDCs may be both wholesale and retail. Whereas retail CBDCs should aim to be available to the common person for all of their transactions on a day-to-day basis, wholesale CBDCs are usually used in facilitating interbank payment by the financial sector. Retail CBDC example is China’s Digital Yuan: it serves to replace the need for physical money and helps conduct financial services on the virtual plain. The European Central Bank and the Federal Reserve also have retail CBDCs in various stages of development. A critical advantage of CBDCs is the full backing from the central banks, which essentially provides the same kind of trust and stability as people have for traditional fiat currencies. CBDCs also empower governments with more effective tools for controlling the money supply and for enforcing monetary policy, such as managing inflation or responding to a financial crisis in real time.

Stablecoins vs CBDCs: Comparing Stability and Control

When analyzing stablecoins vs CBDCs The key difference between them lies in the control and governance level. Stablecoins are normally issued by private entities, such as companies or foundations, and are not controlled by any central authority. This typically confers on them an intrinsic advantage of being decentralized, private, and free from government interference. Yet, it also means that stablecoins might be more vulnerable to further regulatory checks due to this lack of oversight. Still, one cannot deny the fact that stablecoins entail risks. Contrarily, CBDCs are created to be under the control of the government. This makes them strictly regulated and can be used to guarantee complete government control over the issuance, distribution, and monetary policy of the currency. While this central control can create stability and trust, at the same time it is viewed in a way that undermines privacy or surveillance of the transaction. There may always be those who want financial privacy, and users of CBDCs may thus face increased tracking and surveillance of their transactions.

CBDC vs Stablecoin: Adoption and Global Reach

The adoption rates of stablecoins vs CBDCs also show another contrast. Due to their decentralized and flexible nature, stablecoins have gained much usage, especially in the cryptocurrency and DeFi markets. In 2025, stablecoins like USDC and Tether will be highly utilized for cross-border payments and remittances and as a store of value in countries whose currencies are unstable. Their usage is growing more with each passing day because people are trying to escape inflation or exchange digital assets more efficiently. CBDCs, however, remain in infancy. Countries such as China, Sweden, and the Bahamas have demonstrated significant steps toward pilot programs and test launches; however, on a global level, full implementation of CBDCs is still to come into being. Innovation, however, needs balancing on the national governmental level by way of privacy issues, legal hurdles, and existing financial system interference. With the development of CBDCs by the US and EU and other countries, the battle is becoming clearer in terms of choosing between stablecoins and CBDCs. There is an undeniable advantage in using stablecoins being non-sovereign; financial freedom with significantly lower transaction costs would make more people gravitate toward stablecoins. But since CBDCs are institutional backings with full government regulation and oversight, CBDCs should be considered much safer and stabler at least within the scope of the regular financial system.

The Future of Digital Payments: A Hybrid Ecosystem?

This is not to say that the winner takes all for digital payments. There can be a coexistence of stablecoins and CBDCs, with each playing its unique role in the broader financial ecosystem. On one hand, stablecoins could continue to thrive in decentralized applications that are quick, low-cost transactions, and offer privacy while CBDCs assume a seminal role as the backbone of national economies, stability, and ease of everyday transactions. This would also be the case with stablecoins, for instance, as governments can incorporate them into their financial systems. For example, they can offer regulatory frameworks for their use or even develop government-backed stablecoins that offer the same benefits as privately issued ones but with more oversight.

Conclusion

In the debate of stablecoin vs CBDC, both have different advantages, and each has the potential to dominate different aspects of the future of digital payments. Stablecoins are more decentralized, private, and innovative in the cryptocurrency space, while CBDCs are going to provide a state-backed, stable alternative that will ensure government control over monetary policy. The question is then which will dominate: on balance, less instead, we are likely to find a hybrid model in which stablecoins and CBDCs complement each other within the evolving digital economy. The true winner will be determined by which system finds a good balance between innovation, security, and user adoption in a world of continual shifts in technological and regulatory landscapes.