Table of Contents

- 1 Introduction to the SUI’s Journey in the Crypto Space

- 2 SUI 101: What Makes SUI Apart from the Rest of the Market?

- 3 The Grand Vision

- 4 The Whitepaper’s bold claims

- 5 The rollercoaster ride: Price Increases as well as Crashes and market perception

- 6 The ICO and Early Market Movement

- 7 Regulatory Environment

- 8 SUI and. The Titans: What Does The Titans’ Performance Compare?

- 9 The Place It’s Lagged:

- 10 The Deflationary Gambit of SUI’s Method to Supply Tokens

- 11 Price Predictions: Could SUI be at $10 $, $50, or even more?

- 12 Future Price Predictions: Short-Term (2025)

- 13 The Long-Term Future (2030)

- 14 Technical Analysis Snapshot (April 2025)

- 15 The Technical Analysis of the USDT/SUI Chart (1W weekly timeframe)

- 16 1 Fibonacci Retracement Levels Interpretation:

- 17 Harmonic ABCD Pattern Analysis:

- 18 2. EMA 2 EMA SMA 2 EMA & SMA Analysis:

- 19 3. RSI (Relative Strength Index) Analysis:

- 20 4. Gann Analysis (Gann Squares as well as Angles):

- 21 Key Gann Levels:

- 22 5 Trade Strategy and Risk-Reward

- 23 Conclusion: High-Risk, High-Reward Play

Introduction to the SUI’s Journey in the Crypto Space

SUI Coin, a relatively younger competitor in the world of blockchain, came into the market with a clear claim of high scalability and speedy performance. It is positioning itself as a potential competitor with major blockchain platforms like Ethereum, Solana, and Polkadot. The company behind it was Mysten Labs. SUI was created to overcome several of the major issues with older blockchain systems, like slow processing times and the inability to interoperate.

Blockchain’s new capabilities, especially those that facilitate parallel transactions,s have attracted a lot of interest. As with other blockchain initiatives, it is not without many challenges and concerns. Can SUI change the face of decentralized finance (DeFi) and the dApp ecosystem, or will it go on to be a victim of the same fate as numerous other projects that failed?

In this thorough study, we’ll explore the key features of SUI, contrastit with its rivals, and analyze its prospects for expansion and growth.

SUI 101: What Makes SUI Apart from the Rest of the Market?

The Grand Vision

SUI Coin was designed to create an extremely scalable, speedy, and secure cryptocurrency designed for large-scale, decentralized applications (dApps) as well as enterprise-level applications. Its core feature is that SUI makes use of a new Consensus Layer dubbed Narwhal and Tusk for order-of-transaction as well as parallel execution. It sets SUI apart from conventional blockchains like Ethereum and Bitcoin.

The Key Features

Parallel Transaction Processing Contrary to traditional blockchains, which handle transactions in a sequential manner, Parallel execution by SUI ensures less latency as well as higher speed.

Scalability: SUI is built to grow linearly as the number of network nodes grows. SUI is able to theoretically handle millions of transactions per second (TPS) and put SUI in direct opposition to Layer-1 blockchains, such as Solana.

* Instant and Low Latency Infinite Transactions: Transaction finality for transactions on SUI is intended to be immediate, which addresses the problem of delays in transactions, which can be a problem on other platforms.

* Developer-Friendly: The system is built for developers and is able to build smart contracts with Move, the language invented through Facebook’s Diem project.

* Gas Fees SUI utilizes low-cost transaction fees and focuses on making sure that these fees don’t create barriers to the entry of smaller designers or end users.

The Whitepaper’s bold claims

The SUI whitepaper set out ambitious objectives and positioned SUI as a cryptocurrency that can be used to support both advanced decentralized applications with high throughput as well as enterprise-scale solutions. Some of the key points in the whitepaper are:

* Sub-second finalization of transactions.

Horizontal Scalability is realized through its ingenious agreement and model of transaction.

• Low-cost operation and a particular concentration on cutting down user charges to a minimum, which makes it appealing for widespread acceptance.

But, as with many other emerging blockchain technologies remains to be judged if these capabilities can be successfully implemented on a regular basis. As the blockchain project expands, the possibility of scaling and decentralization will be checked as increased transactions flow through the network.

The rollercoaster ride: Price Increases as well as Crashes and market perception

The ICO and Early Market Movement

SUI Coin’s first coin offerings (ICO), also known as token sales, attracted a lot of notice, as did its announcement, making it the next major thing to happen in the world of blockchain. In 2023, the cryptocurrency was announced with great fanfare the market responded forcefully, with traders at the beginning increasing the price by $10 or more before an important correction.

When the price rose, speculation over the use of the cryptocurrency for use in DeFi NFTs, DeFi, and gaming communities generated lots of excitement, particularly considering the importance given to the speed of transaction processing as well as scaling capabilities.

But once the excitement faded, SUI Coin’s price experienced significant fluctuation, just like other blockchain initiatives that also had promising beginnings. As of the writing time, SUI Coin hovers around $2.50 between $2.50 and $3.50, just a small portion of its original value.

Regulatory Environment

Like EOS as well as other notable blockchain initiatives, SUI could face future challenges in the area of regulation as governments across the world try to implement tighter control on blockchain technologies. Although no major regulatory concerns have been identified in the case of SUI, the fact that it has been a major news item implies that it is likely to be subject to scrutiny shortly.

SUI and. The Titans: What Does The Titans’ Performance Compare?

Let’s look at comparing SUI against several of the largest companies in the world of blockchain, such as Ethereum, Solana, Binance Smart Chain, and Polkadot.

| The Feature | SUI | Ethereum | Binance Smart Chain | Solana | Polkadot |

| Consensus | Narwhal & Tusk | PoS (Eth 2.0) | PoSA | PoS + Proof of History | Nominated Proof of Stake (NPoS) |

| TPS | 100,000+ | ~100 (pre-L2) | ~300 | 65,000+ | 1,000+ |

| Fees | Low | High gas fees | Low ($0.01) | Low ($0.00025) | Low |

| Governance | On-chain | Off-chain EIPs | Binance-controlled | On-chain governance | On-chain governance |

| Smart Contract Language | Move | Solidity | Solidity | Rust & C | Rust & Ink |

The place SUI wins:

* High-throughput: SUI’s parallel transaction processing provides faster speed over Ethereum, Solana, and Binance Smart Chain.

• Low costs and minimal latency: The cost of transactions and delays is greatly less than Ethereum, which makes it less expensive for small-scale initiatives.

* Developer-Friendliness: The use of Move, which is becoming popular in the blockchain development community, gives SUI an edge in terms of flexibility and innovation.

The Place It’s Lagged:

* Decentralization character, as a result of the fact that it has a small number of validation agents (or the consensus nodes), could pose the risk of decentralization in its true sense.

* Uncertainty in Regulatory Policy: As with other blockchain initiatives, SUI could face regulatory scrutinization, especially as government agencies take action against crypto activities.

Adoption Risk: As SUI is a relatively new platform, SUI faces the challenge of competing against established platforms such as Ethereum and Solana with significant user bases as well as developer ecosystems.

The Deflationary Gambit of SUI’s Method to Supply Tokens

Contrary to many other traditional blockchains, which are based on inflationary tokenomics, SUI Coin has implemented measures to stop excessive inflation of tokens:

Fixed supply cap: The maximum amount of supply of 10 billion SUI tokens. It also has an automated release plan for longevity.

• Burn Mechanism: A part of the transaction costs on the blockchain are burnt, and this reduces the overall token supply as time goes by. As adoption rises and the supply decreases, it could result in scarcity and increase the cost.

Price Predictions: Could SUI be at $10 $, $50, or even more?

Future Price Predictions: Short-Term (2025)

The conservative estimates predict that the cost will remain between $2 and $4 over the following year, but with minor changes due to market conditions.

The outlook for the future expects SUI to reach the $10 mark if SUI can gain significant momentum in dApp acceptance and corporate use scenarios.

The Long-Term Future (2030)

* $30-$50: Some experts think that the event that SUI can keep up with high throughput and overcome scalability problems that have been a problem for Ethereum, the platform, it will be an important competitor in the space of blockchain.

* $ 100 or more: If acceptance of SUI’s parallel transaction processing has become widespread throughout enterprise applications, NFTs, as well as DeFi, then a cost that is more than $100 per token may be achievable by 2030.

Technical Analysis Snapshot (April 2025)

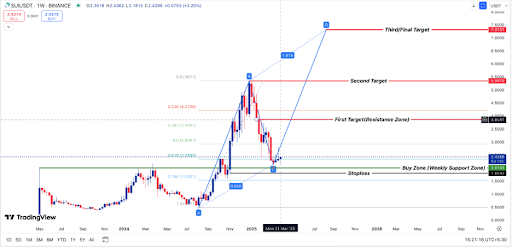

The Technical Analysis of the USDT/SUI Chart (1W weekly timeframe)

This chart depicts SUI/USDT over the weekly chart, displaying the bullish reversal pattern, supported by the Fibonacci retracement levels, harmonic structure, and future goals.

1 Fibonacci Retracement Levels Interpretation:

* 0.236 (4.2108 USDT) * 0.236 (4.2108 USDT) – The initial resistance where there is a possibility of selling pressure could take place.

* 0.382 (3.4992 USDT) It is a high resistance level that could serve as a point of rejection.

* 0.5 (2.9241 USDT) This is a crucial psychological threshold for trend confirmation.

* 0.618 (2.3490 USDT) * 0.618 (2.3490 USDT) – The Golden Ratio, where the prices are currently with a possibility of bouncing.

* 0.786 (1.5301 USDT) * 0.786 (1.5301 USDT) 2.35 USDT is not met, the level may be the final strong support prior to the possibility of a break.

Harmonic ABCD Pattern Analysis:

*The ABCD pattern indicates an upward trend of bullishness starting from point C and D.

If the price is in line with this pattern, we may be seeing a movement towards 7.31 USDT (Final Goal D).

2. EMA 2 EMA SMA 2 EMA & SMA Analysis:

Exponential Moving Averages (EMA) and Simple Moving Averages (SMA):

* EMA 26 (Short-term) Most likely to be under the current price, which suggests resistance around 2.90, 3.50 to 3.50 USDT.

* SMA 50 (Medium-term) About 3.80 3.00 – 4.00 USDT. This is aligned with the initial objective (3.86 USDT).

* SMA 200 (Long-term) It is likely to trade between 5.35 to 5.50 USDT. It’s also in sync with the target for the second one (5.34 USDT).

Interpretation:

* If price moves beyond the 26 EMA, this could set off the bullish trend.

A break above the SMA 50 (3.80 – 4.00 USDT) is a sign of a trend reversal.

*The SMA 200 (5.35 USDT) serves as a key resistance mark.

3. RSI (Relative Strength Index) Analysis:

* RSI is likely to be within the 35-45 range (Near Oversold Zone) – It suggests a possible bearish reversal.

* If RSI is above 50, this indicates strong bullishness.

* RSI Divergence: If price hits a lower level and RSI achieves a higher low, then bullish divergence is verified.

4. Gann Analysis (Gann Squares as well as Angles):

Key Gann Levels:

*2/1 Gann Angle (~2.50 USDT) It provides an extremely strong source of help.

*4/1 Gann Angle (~3.80 USDT) This is the first region where the price could decrease.

*8/1 Gann Angle (~5.50 USDT) If price breaches this mark, it is a sign of the bullish trend that has been going on for a long time.

Interpretation:

* If the price is at or above 2.40 USDT, it could follow the Gann direction until 3.86 USDT, and then 5.34 USDT, then eventually 7.31 USDT.

5 Trade Strategy and Risk-Reward

Entry:

*Buy Zone (2.00 2.35 USDT) – 2.35 USDT)

* Stop-Loss: Lower than 1.80 USDT (to keep from the possibility of)

Targets:

* First Goal (3.86 USDT)

* Second Goal (5.34 USDT)

* Target Final (7.31 USDT)

The Risk-Reward Ratio (RR):

* Entry is at 2.35 USDT. SL is 1.80 USDT

* Target: 7.31 USDT. The RR is 4:1 (High Return Potential)

Conclusion: High-Risk, High-Reward Play

SUI Coin represents a high-risk but high-reward investment within the world of blockchain. Although its technological capabilities and capacity ensure a sturdy basis for future growth, it will have to overcome obstacles, including decentralization fears, in addition to regulatory issues and competitors with different blockchains. If SUI can fulfill its goals, it will rise to new heights; however, like other crypto-related initiatives, its path remains uncertain.

Your move, crypto enthusiasts.

What’s your opinion regarding SUI? Are you convinced that it is the Blockchain of the Future or simply one more one-off flash? Please let me know what you think!